By Laviva Mazhar & Rohan Monga, August 6, 2024

The process of buying cyber insurance for a business is no joke. At Luge, we experienced this first hand when shopping for our own cyber policy.

Today, brokers are using PDF forms that rely on clients to answer a long list of questions that may or may not pertain to their businesses. Questions can be as granular as “how many unique personally identifiable information (PII) records are stored in your network?”. Imagine trying to answer questions like this accurately. It’s a nightmare.

Without a cybersecurity expert in the team, which is rare for most small businesses and even many medium-sized businesses, it can take weeks to collect precise information. Not to mention, these businesses may be left wondering if the answers were accurate or if they would come back to haunt them during a future claim. On the other hand, it is difficult for brokers and insurers to verify the accuracy of the information provided by prospective clients without actually putting their security measures to test. This tedious underwriting process can lead to an inaccurate assessment of a company’s cyber risks and cause significant variations in policy pricing.

This is a big problem, especially given the constantly evolving nature of the cyber risk landscape which is uniquely complex among insurance categories to underwrite profitably. Given the rapidly advancing technologies around us, it is not enough for brokers and insurers to just underwrite cyber risk and sell a policy. They also need to help clients take proactive steps to enhance their security posture and reduce exposure, in order to both reduce the chance of future claims and deliver value to policyholders.

Enter Inscora, a young company building an automated risk assessment and sales enablement platform specifically for cyber insurance brokers to easily and accurately assess their clients’ cyber posture, accelerate the collection of data to apply for insurance, and support them in incorporating cybersecurity best practices to increase insurability and reduce risk. The goal is to reduce the complexities around buying cyber insurance for clients while ensuring they are adequately protecting themselves. A win win for all involved.

Inscora was co-founded by repeat cybersecurity entrepreneur Gabriel Tremblay, who previously co-founded Delve Labs (acquired by Secureworks), Pierre-David Oriol, who worked with Gabriel as VP of Product at Delve Labs, and Guillaume Raymond, former Director of Engineering at Dialogue (acquired by Sun Life Financial). We’re excited to be working with this seasoned team that is bringing their deep cybersecurity expertise to the insurance industry.

A relatively newer risk compared to traditional home, auto and general liability insurance, the cyber insurance market has grown rapidly in the last few years. Between 2017 and 2021, the global cyber insurance market tripled in volume, from gross direct written premiums of US$3.5 billion to US$10 billion, according to the Swiss Re Institute. The space is expected to grow to $22.5 billion of premiums by 2025 and, despite the recent softening of the market, we believe that this growth trajectory will continue in the long term.

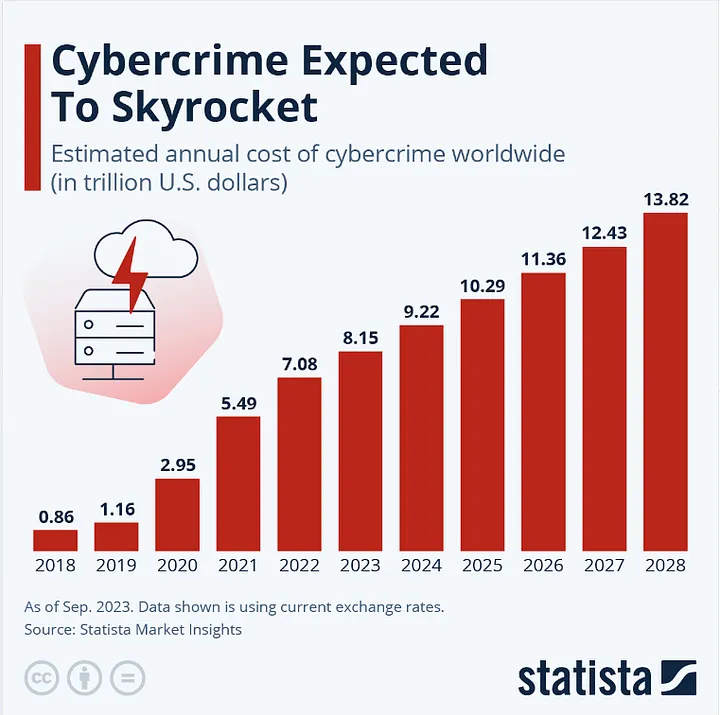

The cyber threat landscape continues to evolve rapidly, driven by technological advancements (such as the increasing use of AI), widespread adoption of cloud-native solutions (increasing attack surfaces), exponential growth of sensitive digital data, increasing sophistication of cyber criminals, and geopolitical unrest. In fact, as seen in the chart below, the global cost of cybercrime is expected to surge in the next four years, rising from US$9.22 trillion in 2024 to US$13.82 trillion by 2028. This goes to show that, despite the growing adoption of cybersecurity tools by businesses, cyber criminals have always remained a step ahead, and their methods will continue to evolve.

Source: Statista — Cybercrime Expected To Skyrocket in Coming Years

While cybercrime-related losses are projected to grow, only a fraction of these risks have been insured so far according to reinsurer Munich Re. Large companies still account for the majority of premiums, while SMBs remain underinsured.

Brokers and agents are at the heart of insurance distribution in North America, and Inscora is on a mission to equip this channel with tools to help them serve their clients better by increasing the accessibility of both cyber insurance and accompanying security measures. We believe that Inscora’s team, with its deep expertise in the cyber space and its network of advisors and early customers in insurance, is in a perfect position to deliver cyber insurance version 2.0 through the broker channel.

If you’re building in fintech at the early-stage, we’d love to hear from you! You can contact us here.