By Rohan Monga, December 19, 2024

What 2024 Taught Us

As we wrap up the year, we’re reflecting on the fintech landscape of 2024. It’s been a year of recalibration—a continuation of the shift that began in 2023, moving away from the frenetic pace of 2021 and its aftershocks in 2022, toward something more grounded and sustainable.

Let’s dive into the key moments and trends that shaped fintech this year.

Global Fintech: A Steady Reset

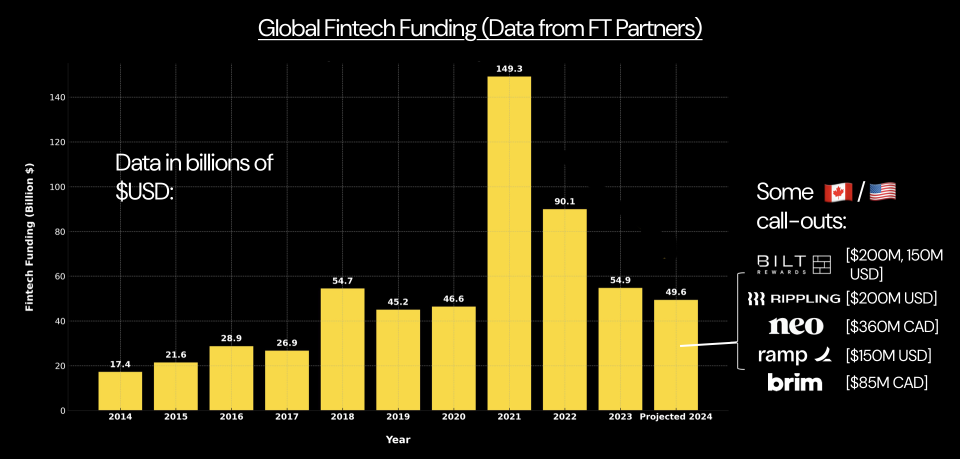

Based on the most recent data from FT Partners, as of Q3, global fintech funding in 2024 is on pace to top out slightly below 2023 levels. While we’d like to see growth YoY, we believe this is a continuation on the path towards a return to normalcy from the craziness of 2021 (which residually extended into 2022).

Data from FT Partners Q3 2024 Quarterly Fintech Insights Report

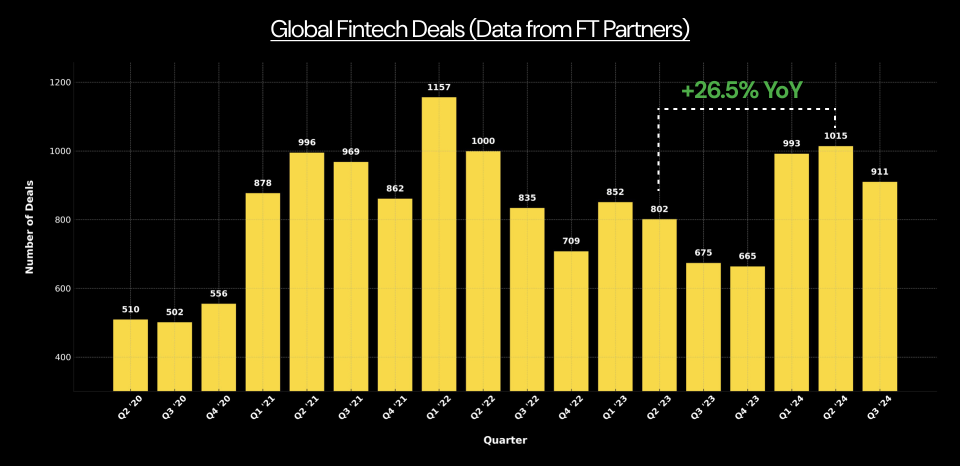

Looking ahead, there’s reason for optimism. While aggregate dollar amounts might be down, global fintech deal count (the number of private financings, irrespective of round size) is trending up in 2024. This is shown in the chart below.

Data from FT Partners Q3 2024 Quarterly Fintech Insights Report

Take Q2 2024 as an example, which saw nearly a 27% year-over-year jump in deal count compared to the same period in 2023. More deals, despite a slight decline in total funding amount, could imply that there was an uptick in activity at the early stage this year. The data supports this implication, as 49% of the fintech financing rounds tracked above for YTD2024 were below US$5M in size – the highest proportion since 2016. We see this as a leading indicator that total funding value (that first chart) is in for a comeback over the next few years. After all, assuming a standard graduation rate from Seed to Series A, Series A to B, Series B to C, etc., more funding at the early-stage is expected to eventually result in more funding at the later stages as well.

Checking in on the Canadian market

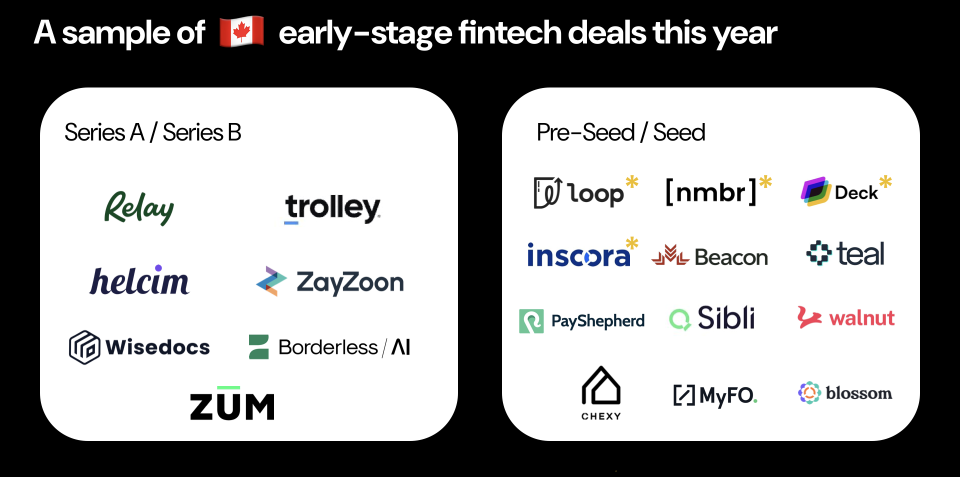

We were excited to see a healthy level of activity at the early-stage in Canadian fintech this year with representation from across the country with particularly strong showings from Alberta, British Columbia, Quebec, and Ontario.

We’ve highlighted some of the Canadian companies that raised money this year below. Notedly, embedded fintech emerged as a key theme, with companies like Walnut (embedded-insurance), Nmbr (embedded-payroll), and Teal (embedded-accounting), all demonstrating how valuable it is to build the infrastructure that allows financial tools to be woven directly into broader platforms. Teal was later acquired by US neobank Mercury this year after their recent fundraise.

* Luge backed four new companies this year: inscora (tools for cyber insurance brokers), Nmbr (embedded payroll), Deck (open data), and Loop Financial (banking solutions for global businesses).

Competitive Rounds and Repeat Founders

Our team observed competitive rounds leading to strong valuations for the top-tier Canadian fintechs and saw continued interest from international investors.

We also saw a welcome surge of repeat founders stepping back into the ring. Take Nmbr, founded by the team behind Humi; Inscora, led by the folks from Delve Labs; or Deck, the team behind Flinks — all companies we’re now proud to have in our portfolio. We feel it’s a great signal for the outlook of the fintech space that some of the smartest people in the industry are coming back with new ventures.

Quality Over Quantity

One big shift in 2024 was a renewed focus on revenue quality. Investors are no longer just chasing fast growth; they’re digging deeper into how that growth happens. SaaS models with long-term contracts are in, while transactional revenues that can experience volatility are trading at lower multiples. Valuations for lower margin businesses like insurtech MGAs writing their own policies have also seen an adjustment back to more sustainable levels.

Speaking of margins, another focal point has been the potential of AI to enhance operational efficiency. Startups that can help both FIs and other startups make operations more efficient by automating functions like customer support, collections, and sales outreach are all gaining momentum. Not only are these interesting opportunities themselves, but they have the possibility to help the next generation of startups improve their margins. Luge portfolio company ProNavigator, which provides a knowledge management system tailor-built for the insurance industry, is a perfect example of this. Not only is AI increasing performance, it’s also decreasing product development times. Another Luge portfolio company, Owl, quickly expanded this year into medical case summaries and claims data insights for the insurance industry.

What’s Next?

While 2024 showed that funding is not at the levels of 2021 and 2022, we feel there’s an asterisk beside that statistic. Deal counts are up, and fintech’s foundation remains solid and resilient, with a strong focus on sustainable growth and long-term value creation.

As we look ahead to 2025, there’s so much to be excited about. Based on our conversations with some of our LPs—major financial institutions like Desjardins, Industrial Alliance, and Sun Life Financial—we’re seeing a growing appetite from FIs to further collaborate with fintech startups. This change hasn’t happened overnight, but we’re seeing, more than ever, FIs being willing to work with startups to better serve their clients and improve operations.

In terms of what else is to come, we feel we’re at the tip of the iceberg when it comes to the next generation of fintech. Infrastructure to support AI agents that can make purchases, fully automated customer support, streamlined compliance, portable identity solutions, self-driving money systems, insurance for new types of risk like deepfakes – these are just a few examples of what’s on the horizon.

Here at Luge, we’re excited to be actively writing checks out of our new Fund II in fintech startups across Canada and the US. If that’s you, give us a shout!

This post draws on key insights from Rohan’s presentation at Fintech Cadence’s final event of the year, held at Montreal’s Espace CDPQ on November 21st. As a proud partner of Fintech Cadence, Luge acknowledges their pivotal role in cultivating a vibrant fintech community and facilitating critical discussions that advance the Canadian fintech ecosystem.